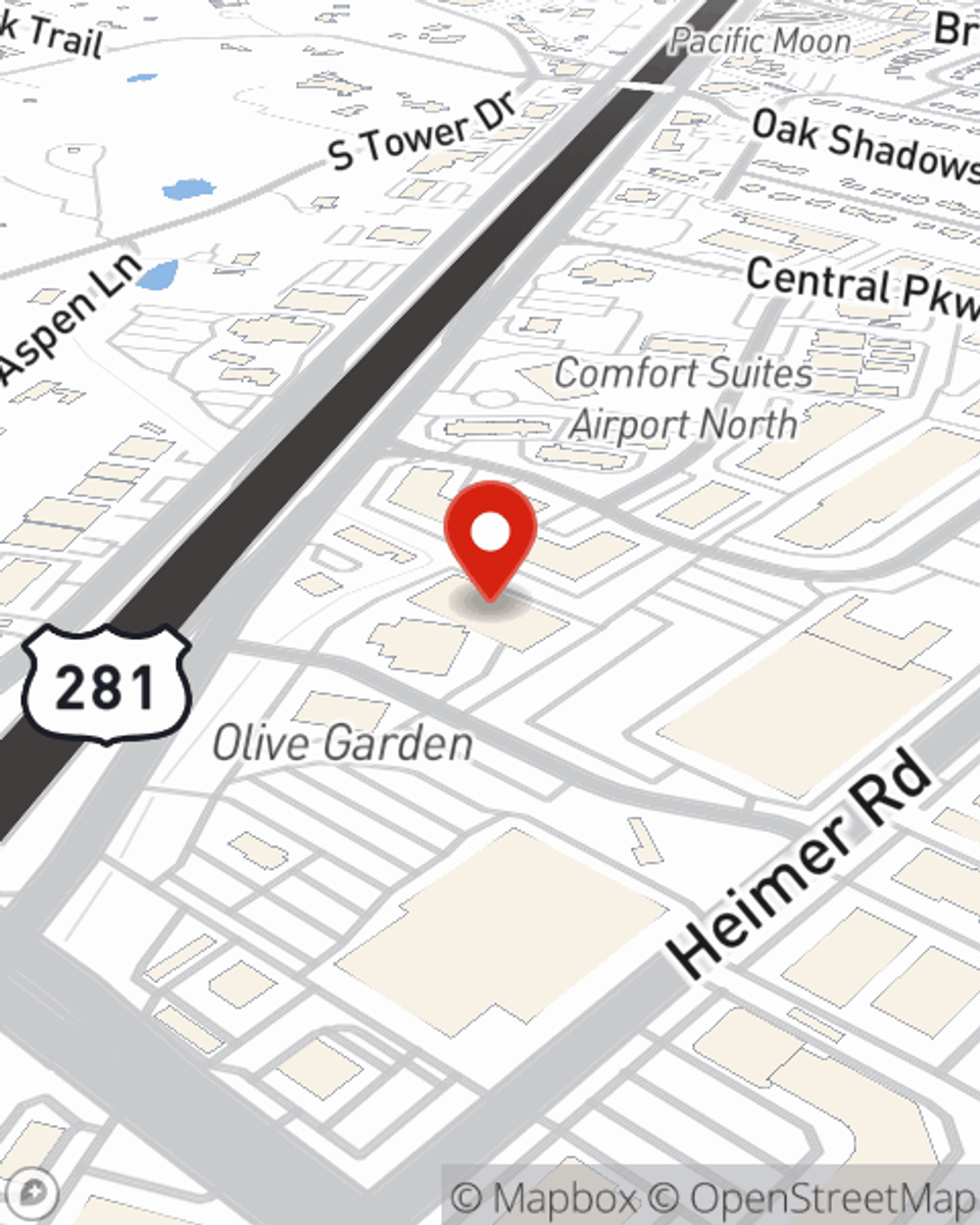

Business Insurance in and around San Antonio

One of San Antonio’s top choices for small business insurance.

Cover all the bases for your small business

- San Antonio

- Bexar County

- Lackland AFB

- Stone Oak

This Coverage Is Worth It.

Small business owners like you have a lot of responsibility. From financial whiz to inventory manager, you do everything you can each day to make your business a success. Are you a dog groomer, a real estate agent or a pet groomer? Do you own a shoe repair shop, a dental lab or a deli? Whatever you do, State Farm may have small business insurance to cover it.

One of San Antonio’s top choices for small business insurance.

Cover all the bases for your small business

Keep Your Business Secure

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, commercial auto or business owners policies.

Let's review your business! Call Norma Lopez Petre today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Norma Lopez Petre

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.